Meta Description: Explore how CodeWint Technologies developed BlackBird Trade, a crypto trading Telegram bot with MLM features, using MERN stack and AWS. Learn about custom cryptocurrency development and secure trading systems.

Introduction: The Rise of Crypto Trading Platforms

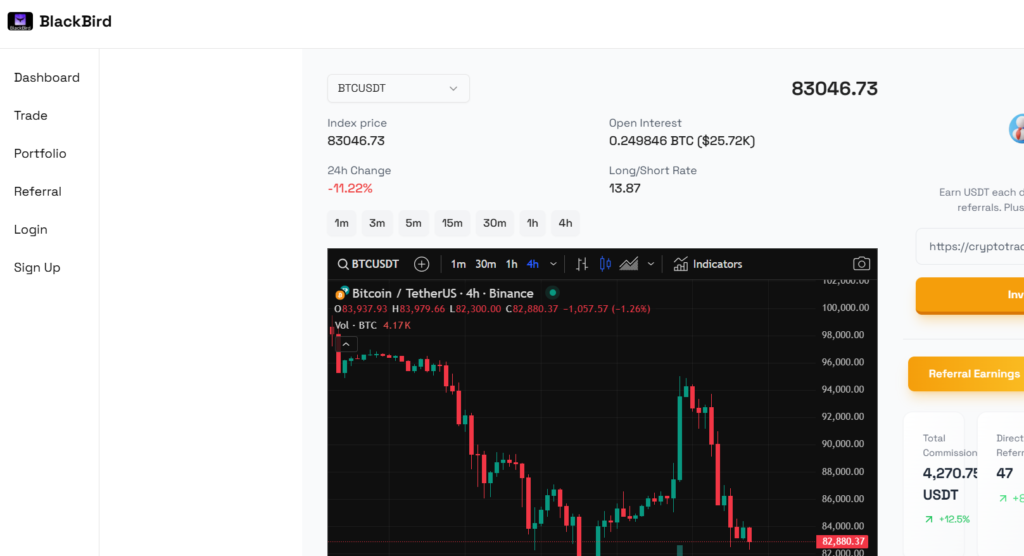

The cryptocurrency market has surged, demanding accessible, secure, and user-friendly trading solutions. CodeWint Technologies answered this need with BlackBird Trade, a Telegram-based crypto trading bot integrated with MLM referral systems. Built on the MERN stack (MongoDB, Express.js, React, Node.js) and deployed on AWS, this platform enables users to buy/sell cryptocurrencies, earn via referrals, and engage in a seamless trading experience. This case study explores the development journey, technical strategies, and SEO-focused insights for keywords like Crypto Development, Custom Cryptocurrency Development, and Telegram Bot creation for MLM and Crypto.

1. Market Need: Why BlackBird Trade?

Challenges in Existing Crypto Platforms:

- Complex interfaces deterring novice users.

- Lack of integrated referral (MLM) systems.

- Security concerns in decentralized trading.

Solution Overview:

BlackBird Trade simplifies crypto trading through a Telegram bot, combining real-time transactions, custom token support, and a referral rewards program. Its intuitive design bridges the gap between advanced traders and newcomers.

2. Custom Cryptocurrency Development: Building Flexibility

Tailoring Crypto Solutions:

CodeWint Technologies integrated support for custom tokens, enabling users to trade both mainstream (Bitcoin, Ethereum) and niche cryptocurrencies. Key steps included:

- Smart Contract Development: ERC-20 standard for token interoperability.

- Wallet Integration: Secure multi-currency wallets with two-factor authentication (2FA).

Challenges Overcome:

- Ensuring cross-blockchain compatibility.

- Balancing scalability with transaction speed.

3. Crypto Trading System Development: Architecture & Security

MERN Stack Advantages:

- MongoDB: Scalable NoSQL database for user/transaction data.

- React: Dynamic frontend for the web dashboard.

- Node.js & Express.js: Robust backend API handling real-time trades.

Security Measures:

- End-to-end encryption for transactions.

- Regular audits to prevent vulnerabilities.

- AWS Shield for DDoS protection.

4. Building the Telegram Bot: MLM & User Engagement

Why Telegram?

- Massive crypto community presence.

- Bot API supports rich interactions (buttons, inline queries).

Features Developed:

- /trade: Execute buy/sell orders directly in chat.

- /referral: Generate invite links, track commissions.

- /wallet: Check balances and transaction history.

MLM Mechanics:

- Tiered referral rewards (5%–15% commission on invites).

- Transparent tracking via referral IDs.

5. AWS Deployment: Scalability & Reliability

Infrastructure Setup:

- EC2 Instances: Hosting Node.js backend.

- S3 Buckets: Storing static assets (React frontend).

- RDS: Managed MongoDB database for high availability.

Benefits:

- Auto-scaling during traffic spikes.

- 99.9% uptime guaranteed.

Conclusion: Pioneering Crypto Innovation

CodeWint Technologies’ BlackBird Trade exemplifies how custom cryptocurrency development and Telegram bot integration can revolutionize crypto trading. By prioritizing security, usability, and community-driven growth, the platform sets a benchmark in crypto trading system development.