In India’s bustling retail ecosystem, small and medium-sized retailers are the lifeline of communities. From kirana stores to mobile recharge shops, these businesses serve millions daily. Yet, managing bill payments for utilities, recharges, and financial services has long been a headache. CodeWint Technologies, a pioneer in fintech innovation, recognized this gap and developed SVVPay—a B2B recharge software and bill payment platform powered by BBPS (Bharat Bill Payment System) APIs. This case study explores how SVVPay, built by CodeWint Technologies, transformed retailers into digital service hubs, simplifying transactions and boosting revenue.

The Problem: Why Retailers Needed a Unified Solution

Before SVVPay, retailers faced crippling challenges:

- Fragmented Platforms: Switching between apps for electricity, water, Fastag, and mobile recharges.

- Manual Errors: Time-consuming data entry leading to customer disputes.

- Limited Services: Inability to offer insurance premiums, loan EMIs, or PlayStore recharges.

- Lost Customers: Shoppers left stores to pay bills at dedicated centers.

- Security Risks: Lack of integration with RBI-approved systems like BBPS.

The Solution: CodeWint Technologies’ SVVPay

CodeWint Technologies designed SVVPay as a multi recharge software and bill payment platform to empower retailers. The goal? Consolidate 100+ services into one dashboard using BBPS APIs, ensuring speed, security, and scalability.

Core Objectives:

- Simplify B2B bill payments for retailers.

- Offer white label recharge software options for branding.

- Ensure RBI compliance via BBPS integration.

How SVVPay Works: The Power of BBPS APIs

BBPS, regulated by the RBI and NPCI, is India’s interoperable bill payment ecosystem. CodeWint Technologies leveraged BBPS APIs to create SVVPay’s backbone:

- Real-Time Bill Fetching: Instantly retrieve dues for electricity, water, gas, etc.

- Multi-Payment Channels: Accept cash, UPI, cards, or wallets.

- Automated Reconciliation: Sync transactions with retailers’ accounts daily.

Technical Workflow:

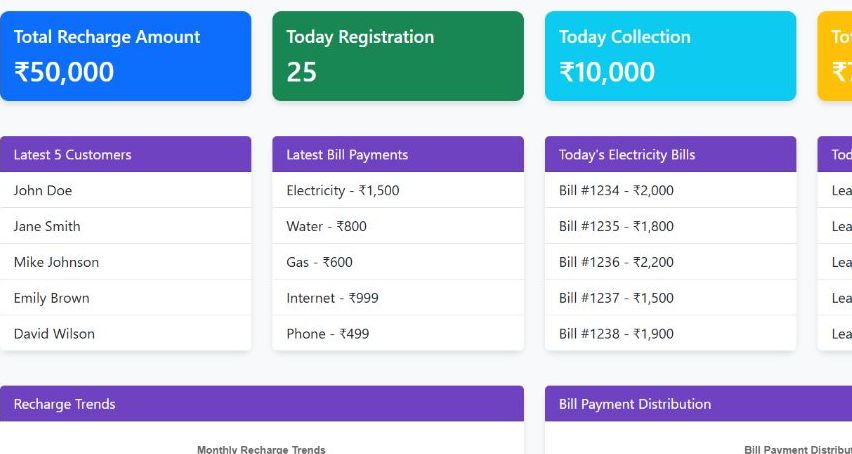

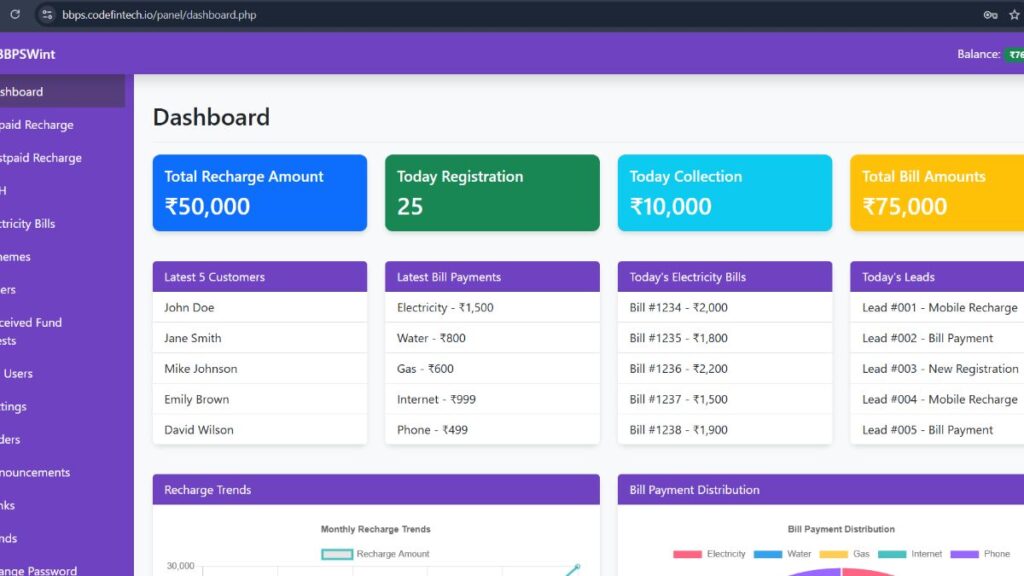

- Retailer logs into SVVPay’s recharge B2B software dashboard.

- Selects a service (e.g., “LIC Premium” or “Jio Recharge”).

- Enters customer details → BBPS API fetches the bill.

- Processes payment → Generates SMS/email receipt.

Key Features of SVVPay by CodeWint Technologies

- All-in-One Bill Payments Software

- Utility Bills: Electricity (DISCOMs), water, gas, Fastag.

- Financial Services: Insurance premiums, loan EMIs, mutual funds.

- Recharges: Mobile, DTH, metro cards, PlayStore vouchers.

- BBPS API Integration: Access 20,000+ billers nationwide.

- White Label Recharge Software

- Customizable interface for brands to add logos, colors, and pricing.

- Ideal for franchises or enterprises wanting their own recharge platform.

- Multi-Platform Accessibility

- Web dashboard, Android/iOS apps, and POS compatibility.

- Real-Time Analytics & Reports

- Track commissions, top-performing services, and customer trends.

- Automated Alerts

- Notify customers about due bills via SMS.

- Offline Mode

- Process payments in low-network areas (syncs when online).

Implementation: CodeWint’s Strategy for Success

CodeWint Technologies executed a 3-step rollout:

1. Onboarding

- Retailers completed KYC via Aadhaar-based verification.

- Free demo sessions to explore the multi recharge software.

2. Training

- Regional-language video tutorials and live webinars.

- Focus on BBPS API services like PAN card verification.

3. Support

- 24/7 chatbot and helpline for transaction failures or technical glitches.

Results: How SVVPay Transformed Retailers’ Businesses

- 50% More Foot Traffic: Customers attracted by “one-stop” convenience.

- 35% Revenue Growth: Commissions from recharges, bill payments, and referrals.

- 80% Faster Transactions: From 7 minutes to under 90 seconds.

- Zero Manual Errors: Automated BBPS API validation eliminated disputes.

Overcoming Challenges: CodeWint’s Expertise

- BBPS API Integration Complexity

- Partnered with NPCI-certified experts to ensure seamless API sync.

- Retailer Hesitation

- Launched regional campaigns (e.g., “Ab Bill Bharo, Ghar Baitho”).

- Technical Downtime

- Deployed cloud servers with 99.99% uptime for uninterrupted service.

SVVPay vs. Competitors: Why Retailers Chose CodeWint

| Feature | SVVPay | Competitors |

|---|---|---|

| BBPS API Coverage | 20,000+ billers | Limited to 5,000 billers |

| Recharge Services | Mobile, DTH, Water Electricity Bills, Insurance payments, Loan EMIs, Fastag, Credit Card Bills etc. | Only mobile/DTH |

| Pricing | No hidden fees; pay-per-use model | Monthly subscriptions |

| White Label Option | Available | Rarely offered |

Future Roadmap: CodeWint’s Vision for SVVPay

- AI-Powered Insights

- Predict customer preferences (e.g., “Your customers often recharge ₹299 plans”).

- Rural Expansion

- Offline BBPS payments for villages with patchy internet.

- AEPS Integration

- Enable cash withdrawals via Aadhaar authentication.

- Global Bill Payments

- Support NRI services like international mobile recharges.

Why CodeWint Technologies Stands Out

As a leader in bill payments software, CodeWint combines technical expertise with grassroots understanding:

- BBPS API Specialists: 7+ years of fintech experience.

- Scalable Solutions: From small shops to enterprise white label recharge software.

- Customer-Centric Design: Interfaces optimized for Tier 2/3 cities.

Conclusion

SVVPay, developed by CodeWint Technologies, has redefined B2B bill payments by merging BBPS API efficiency with user-friendly design. Retailers now enjoy higher revenue, loyal customers, and a future-ready digital toolkit.